The Battle for Solana Meme Launchpad Dominance

Pump.fun remains the king of Solana meme token launchpads, but challengers like LetsBonk, Bags, Moonshot, and Heaven rise and fall quickly. Flintr aggregates them all in real time.

Table of Contents

- 1. Introduction: Launchpads as Solana’s Growth Engine

- 2. Pump.fun: Created in 2023, Still the Master

- 3. April 2025: The Launchpad Explosion

- 4. Challengers Rising and Falling

- 5. Deep Dive: The Rise of Heaven

- 6. Dynamics of the Launchpad Wars

- 7. The Rise of White-Label Launchpad Infrastructure

- 8. Flintr: Aggregating 99% of Token Launches

- 9. Conclusion: Pump.fun Anchors, but Flintr Sees All

1. Introduction: Launchpads as Solana’s Growth Engine

Meme tokens are more than a passing fad - they’ve become the heartbeat of Solana’s retail energy. Every week, thousands of new tokens are minted, traded, pumped, and rugged. This relentless churn isn’t powered by institutions or corporate treasuries, but by a new wave of platforms: lightweight launchpads that make token creation a one-click affair.

But the past year has revealed a paradox: launchpads themselves are just as volatile as the tokens they host. New players explode onto the scene, capture attention, then just as quickly fade into obscurity.

Through it all, Pump.fun has remained the gravitational center of the meme token universe - the launchpad that started it all and still commands the lion’s share of launches and liquidity. Yet since spring 2025, a flood of challengers - LetsBonk, Bags, Moonshot, and most recently Heaven - has reshaped the battlefield. Each enjoyed a moment of brilliance, rapid adoption, and sudden decline, leaving traders and builders scrambling to keep up.

2. Pump.fun: Created in 2023, Still the Master

Pump.fun launched in early 2023 and instantly redefined token creation. By abstracting away the complexity of smart contracts and liquidity pools, it gave anyone with a wallet the ability to create and launch a token in seconds. Overnight, meme coins shifted from being the domain of insiders to an open playground for anyone with an idea and a meme.

Crucially, Pump.fun introduced a graduation mechanic. Tokens that reached key liquidity milestones could “graduate” (first to Raydium, now to PumpSwap, their proprietary platform), where they gained deeper pools, better price discovery, and more visibility. This simple mechanic gamified launches, turning every token into a wager: would it survive long enough to graduate, or vanish into obscurity?

By 2024, Pump.fun was not just the market leader - it was the cultural hub of Solana’s meme economy. It combined unmatched liquidity, the largest active trader base, and - most importantly - the reputation of being “the place where it all happens.” Competitors came and went, but Pump.fun remained the king.

3. April 2025: The Launchpad Explosion

For nearly two years, Pump.fun enjoyed near-total dominance. But in April 2025, the landscape shifted. A wave of new launchpads appeared almost overnight, sparking what many now call the launchpad wars.

The timing wasn’t random. Several forces converged:

- Cheap liquidity: Solana’s rising price and lower fees made launching tokens easier than ever.

- Copy-paste innovation: Pump.fun’s mechanics inspired clones and experiments, lowering barriers to entry.

- Hype cycles: Traders, fresh off profitable runs, flocked to any venue promising faster pumps or new narratives.

4. Challengers Rising and Falling

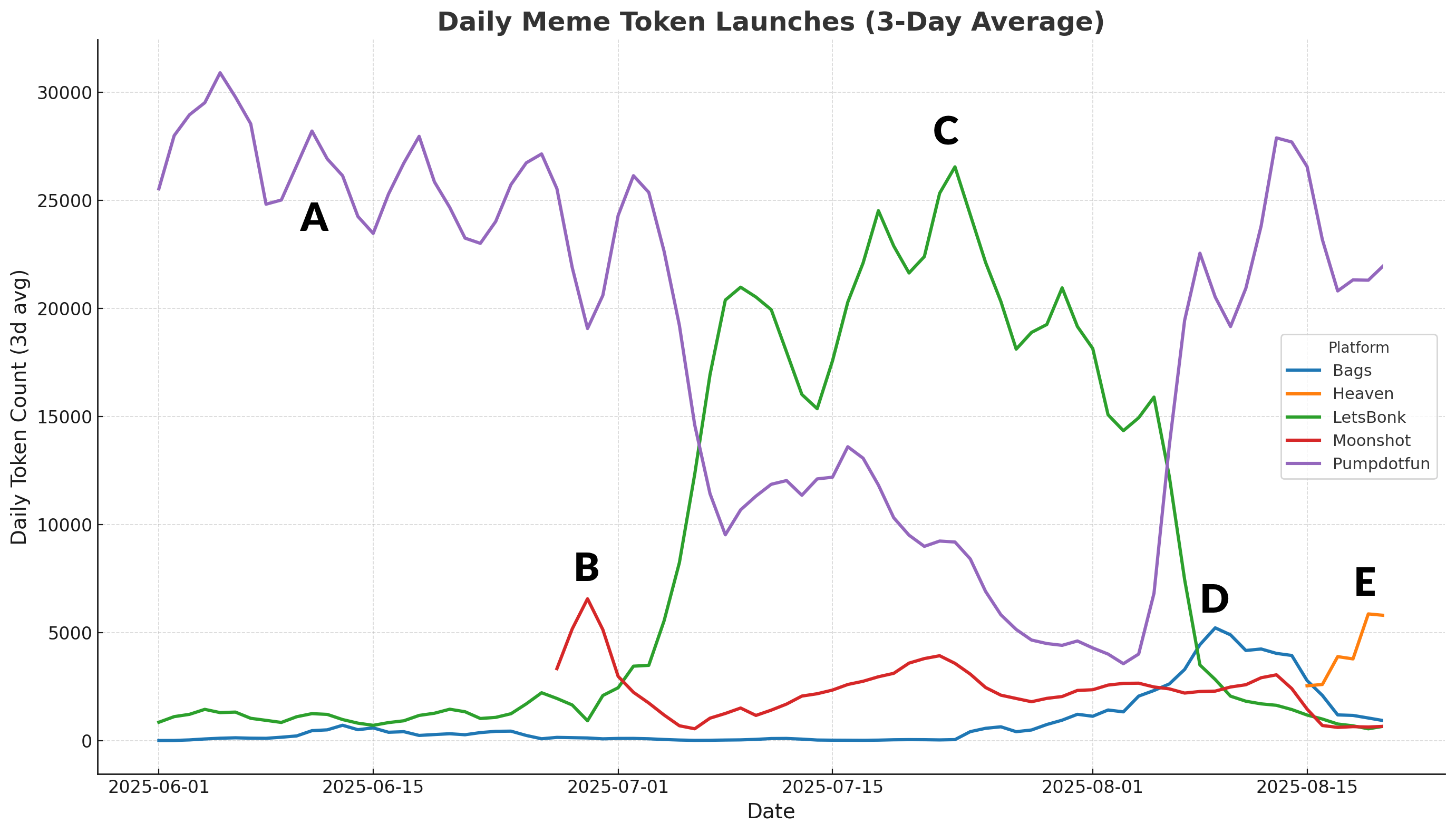

While Pump.fun has remained the gravitational anchor of Solana meme launches, its throne has been challenged repeatedly. Since April 2025, a series of competitors rose quickly, grabbed attention, and then faded almost as fast. From April onward, challengers multiplied. LetsBonk leaned on BONK’s brand. Bags rode novelty and meme marketing. Moonshot pitched a slicker UX. And by mid-summer, Heaven emerged as the first credible alternative to Pump.fun. The result was a fragmented battlefield, with traders cycling rapidly between platforms in search of the next big run.  Source: Flintr.io data stream

Source: Flintr.io data stream

- A: Pump.fun baseline, consistently dominant

- B: Moonshot surge

- C: LetsBonk waves: rapid spike and pullback

- D: Bags acceleration

- E: Heaven emerges

Each tells a story of how hard it is to break Pump.fun’s moat.

🐶 LetsBonk

Built on Solana’s most famous meme coin brand, BONK, LetsBonk captured immediate attention. Its volumes spiked whenever BONK itself trended, riding waves of community hype. But those surges were followed by just as steep crashes - the market share chart looks like a rollercoaster, with bursts of energy followed by sharp drop-offs.

In hindsight, LetsBonk shows both the power and the limits of community-driven brand extensions. Hype can win a week, but sustaining liquidity requires more than a meme.

👜 Bags

Bags briefly stole the spotlight in May 2025. At its peak, it held over 10% of market share, fueled by clever branding and aggressive marketing. Traders piled in quickly, chasing fresh narratives.

But like many meme-fueled projects, Bags lacked staying power. Within weeks, volumes fell as traders migrated back to Pump.fun or toward newer hypes. What looked like a rising star quickly faded into the margins.

🚀 Moonshot

Moonshot pitched itself as the “slicker UX alternative” to Pump.fun. It enjoyed early bursts of activity, particularly among traders attracted to its clean interface and promises of innovation. But growth plateaued fast.

Without a differentiator beyond design polish, Moonshot remained “just another launchpad” in practice. Its trajectory shows that UX alone isn’t enough to pull traders away from Pump.fun’s network effects.

5. Deep Dive: The Rise of Heaven

No competitor in 2025 has generated as much buzz as Heaven. Positioned as both a launchpad and a vertically integrated DEX, it promises not only to mint tokens but also to change how value accrues back to its ecosystem. Backed by the Solana Foundation’s Colosseum accelerator, Heaven isn’t just another Pump.fun clone - it represents a full-stack experiment in tokenomics and infrastructure.

Its flagship innovation is the so-called “God Flywheel”:100% of Heaven’s protocol revenue is used to buy back its native token, LIGHT. Every listing, every trade, every fee flows back into LIGHT buy pressure, creating a reflexive loop between platform activity and token price. Within days of launch, Heaven had burned more than $1.4M worth of LIGHT(around 2% of total supply) and the price spiked over 225% to reach a $64M market cap.

🚀 Heaven’s Early Performance

- ICO raised $27M in under 12 hours, closing early from oversubscription.

- Initial burn rate: $1.4M+ in revenue destroyed, tightening supply almost immediately.

- Captured nearly 20% of Solana meme launchpad share in its first week.

- LIGHT token soared over 225% in days, with community buzz fueling demand.

But Heaven’s design is more than hype. By bundling the launchpad and DEX into a single system (proprietary AMM), it ensures every trade routes fees back into its buyback loop. No leakage, no reliance on third-party AMMs. Traders speculating on new launches are simultaneously fueling LIGHT’s reflexive cycle.

To combat MEV and predatory sniping, Heaven also introduced a 6-second decaying tax on all new launches - starting high and dropping linearly to zero. This “sniper tax” blunts front-running bots and levels the playing field for early participants. Meanwhile, its tiered creator fee system - 1% for “Creator,” 0.1% for “Community,” and 0% for “Blocked” tokens - signals reputational categories while stabilizing the fee base that funds LIGHT buybacks.

⚖️ Heaven vs. Pump.fun

- Pump.fun dominates through culture, liquidity, and its graduation mechanic into PumpSwap.

- Heaven ties success directly to its tokenomics: more usage → more fees → more LIGHT buybacks.

- Pump.fun thrives on inertia - creators default there by habit. Heaven tries to bribe attention structurally.

- Heaven’s anti-MEV and reputation-based fees add defenses Pump.fun doesn’t yet have, but its closed ecosystem could limit long-term liquidity.

The critical question: is Heaven’s flywheel sustainable? Buybacks and burns create powerful reflexivity during growth, but they depend on continued throughput. If trading volumes dip, so does the fuel for LIGHT’s appreciation. Where Pump.fun relies on culture and sheer inertia, Heaven relies on an engineered economic loop - one that must prove it can endure past its honeymoon phase.

For now, Heaven remains the most serious challenger since Pump.fun’s inception. But whether it matures into a permanent fixture or fades like Bags and LetsBonk will hinge on its ability to maintain traction once the hype cools.

6. Dynamics of the Launchpad Wars

Why do challengers rise and fall so quickly? Because the battlefield is governed by brutal dynamics:

- Liquidity is mercenary: traders follow where the action is, not loyalty.

- Creators chase visibility: they launch where the traders already are.

- Attention spans are short: meme cycles can last days, not weeks.

- Network effects are fragile: even dominant platforms must fight to retain users.

These dynamics explain both Pump.fun’s resilience and Heaven’s slowdown. Network effects are sticky, but not unbreakable. Incentives can ignite growth, but rarely sustain it. And in Solana’s meme economy, speed and attention are the only currencies that matter.

7. The Rise of White-Label Launchpad Infrastructure

One reason new launchpads multiplied so quickly in 2025 is that building a launchpad no longer required building real infrastructure. Instead, projects could spin up“white label” launchpads using platforms like Meteora.

Meteora and similar middleware providers offer turnkey liquidity and launchpad frameworks. For a small integration fee (or sometimes open-source code), anyone can deploy a branded launchpad without developing the bonding curves, liquidity mechanics, or backend infrastructure from scratch. In practice, this meant that within weeks, copycat launchpads could appear - each with a fresh name, a slick logo, and a slightly tweaked incentive model.

⚙️ White-Label Mechanics

- Plug-and-play bonding curves: standardized token pricing and graduation mechanics, ready out-of-the-box.

- Liquidity bootstrapping: automatic pool creation, seeded with minimal capital.

- APIs and dashboards: basic data feeds and creator interfaces branded under the new launchpad’s name.

- Custom branding: the core infra is the same, but logos, themes, and incentive structures make it look unique.

This dynamic explains why the barrier to entry collapsed. Instead of engineering new primitives, many challengers simply re-skinned existing infrastructure. That’s why we saw names like LetsBonk, Bags, Moonshot, and even smaller clones appear so rapidly after April 2025 - often with near-identical mechanics under the hood.

The takeaway is clear: launchpads became commoditized. The hard part wasn’t building the tech; it was sustaining liquidity, attention, and culture. That’s why Pump.fun, with its cultural dominance and graduation moat, has remained king despite dozens of “white label” challengers entering the field.

8. Flintr: Aggregating 99% of Token Launches

For traders and developers, the chaos of launchpad wars creates two existential challenges:

That’s why a unified aggregator is no longer optional - it’s essential. Instead of chasing each launchpad manually, traders need a single, reliable feed that captures everything instantly.

🚀 What Flintr Delivers

- 99%+ coverage: launches and graduations from Pump.fun, Heaven, Bags, Moonshot, LetsBonk, and more.

- Real-time signals: WebSocket + REST APIs with sub-500ms latency.

- Developer-ready: clean JSON payloads designed for bots, dashboards, and analytics.

- Battle-tested: 99.9% uptime - infrastructure built for professional use.

In short: Flintr abstracts away the chaos of the launchpad wars and gives you one feed, one dashboard, one truth.

🔮 Looking Forward

- Pump.fun will remain the anchor: cultural and liquidity gravity are too strong to displace quickly.

- Heaven is the wildcard: if it sustains ~20% share and builds structural features, it may become a permanent fixture.

- New challengers will emerge: as long as the meme coin meta thrives, new platforms will appear.

- Consolidation is inevitable: many will vanish, but there will always be “the next one.”

9. Conclusion: Pump.fun Anchors, but Flintr Sees All

The Solana meme token ecosystem is defined by its volatility. Launchpads like LetsBonk, Bags, Moonshot, and Heaven have proven that challengers can rise quickly - but sustaining momentum is far harder. Through it all, Pump.fun has remained the king.

For traders and builders, the real edge isn’t about predicting which launchpad dominates next. It’s about ensuring you see them all. With capital moving faster than ever, a single vantage point is no longer optional - it’s the only way to stay alive.

👉 Flintr: One feed. All launchpads. Zero blind spots.